Some Known Factual Statements About Offshore Company Formation

Table of ContentsRumored Buzz on Offshore Company FormationThe Of Offshore Company FormationThe Of Offshore Company FormationIndicators on Offshore Company Formation You Need To Know

Hong Kong enables production of overseas business and also overseas checking account if your company does not sell Hong Kong region. Additionally, in this instance, there will certainly be no business tax obligation applied on your profits. Offshore firms in Hong Kong are appealing: steady jurisdiction with outstanding track record as well as a reliable overseas financial system.

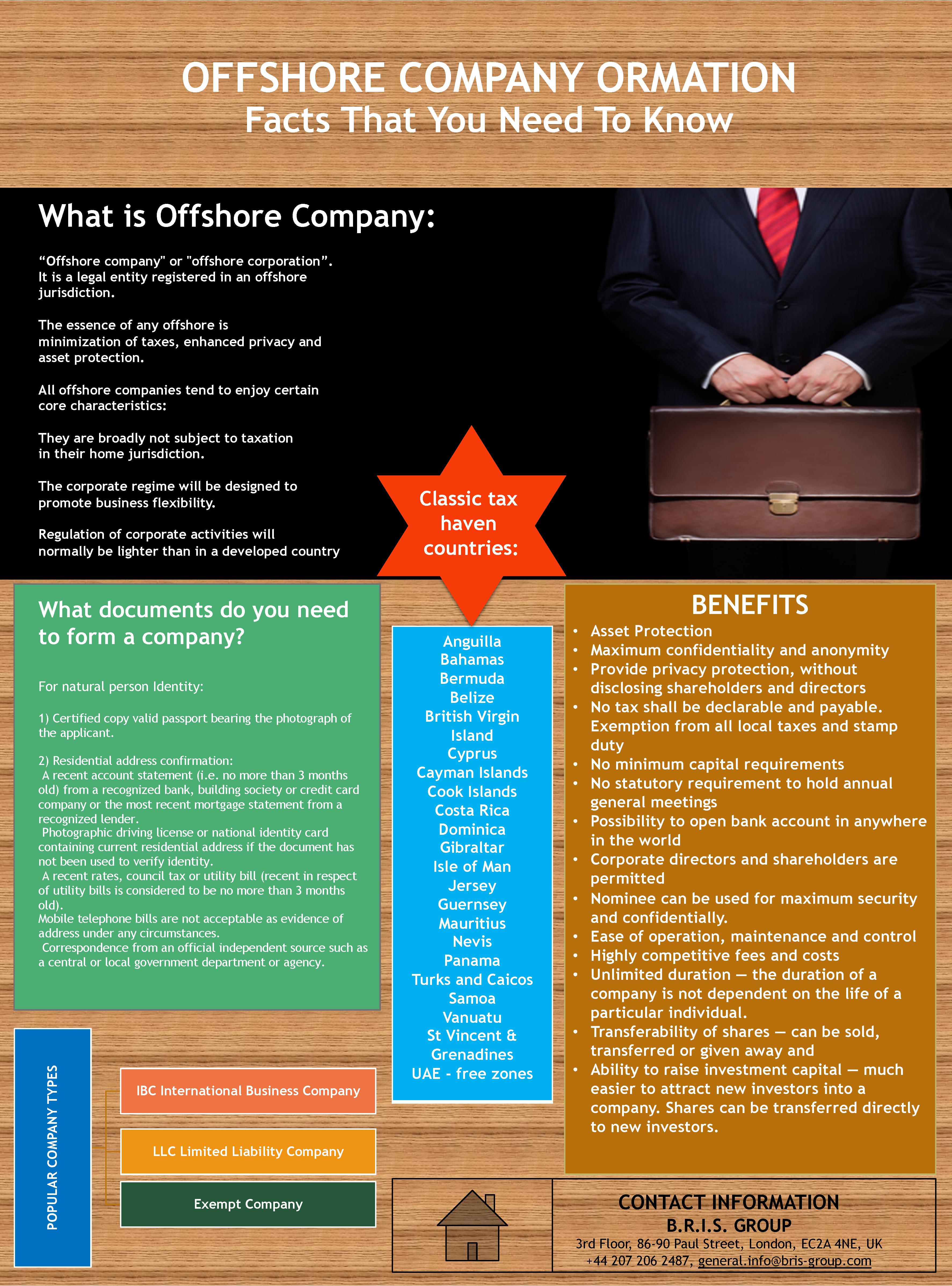

Although there are no clear distinctions as a result of the specific business regulations of each country, usually the major differences are tax framework, the degree of confidentiality and possession security. Several countries want to bring in foreign companies and financiers by introducing tax obligation regulations friendly to non-residents and also global firms. Delaware in the USA for instance is traditionally one of the biggest tax places in the world.

Offshore tax sanctuaries are often labelled as a method for tax evasion. This is commonly as a result of their rigorous secrecy and also possession security laws as they are not obligated to report or disclose any type of information to your country of residence. That does not imply you do not have to comply with legislations where you are resident in terms of financial reporting responsibilities.

Some Known Details About Offshore Company Formation

The term offshore refers to the firm not being resident where it is formally integrated. Additionally, frequently greater than not, the supervisors and also various other participants of an overseas company are non-resident also contributing to the firm not being resident in the nation of enrollment. The term "offshore" might be a bit complex, due to the fact that numerous contemporary monetary centres in Europe, such as Luxembourg, Cyprus as well as Malta offer worldwide service entities the exact same advantages to non-resident firms as the standard Caribbean "tax obligation sanctuaries", however frequently do not utilize the term offshore.

Nevertheless, that does not imply you do not need to adhere to legislations where you are resident in terms of monetary reporting obligations. The confidentiality by having an offshore business is not regarding concealing properties from the federal government, but concerning personal privacy as well as defense from baseless legal actions, threats, partners as well as other legal disputes.

The term offshore and complication bordering such firms are often related to illegalities. Overseas firms act like any kind of typical firm yet are held in different territories for tax functions hence offering it benefits. This does not suggest it acts prohibited, it's just a way to optimise an organization for tax and also protection objectives.

What Does Offshore Company Formation Mean?

These are commonly restrictive demands, high overheads as well as disclosure policies. Although anybody can start a business, not every can obtain the exact same advantages. One of the most common benefits you will locate are: Easy of registration, Very little fees, Versatile monitoring and also minimal coverage needs, No international exchange restrictions, Beneficial regional business legislation, High confidentiality, Tax benefits, Minimal or no constraints in concerns to company activities, Relocation opportunities Although it truly depends upon the laws of your nation of you can try these out residence and also just how you desire to optimize your business, typically online companies and also anything that is not reliant on physical infrastructure frequently has the best benefits.

Tasks such as the below are the most typical and advantageous for offshore enrollment: Offshore cost savings and financial investments Forex and supply trading, Ecommerce Expert service company Internet services Worldwide based firm, Digital-based Firm, Worldwide trading Ownership of copyright Your nation of home will ultimately specify if you can end up being entirely tax-free or otherwise (offshore company formation).

Although this listing is not exhaustive and does not necessarily put on all territories, these are generally dispatched to the registration office where you wish to register the firm.

is an enterprise which just accomplishes financial tasks outside the nation in which it is signed up. An offshore firm can be any kind of enterprise which does not run "at house". At the same time, according to popular opinion, an offshore firm is any type of business which appreciates in the country of enrollment (offshore company formation).

The Basic Principles Of Offshore Company Formation

Setting up an overseas business appears difficult, however go to this website it worth the initiative. A common factor to establish up an overseas business is to meet the legal demands of the nation where you wish to purchase property. There are numerous offshore jurisdictions. We always seek to find. They all satisfy the extremely high standards of, which are basic aspects in picking your offshore location.

Because discretion is just one of one of the most vital facets of our work, all info gone into on this type will be maintained purely personal (offshore company formation).

Even prior to explaining on how an overseas business is formed, we initially require to recognize what an overseas business really is. This is a business entity that is created as well as runs outside your country of home. The term 'offshore' in financing refers to business methods that are situated outside the proprietor's nationwide limits.